|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

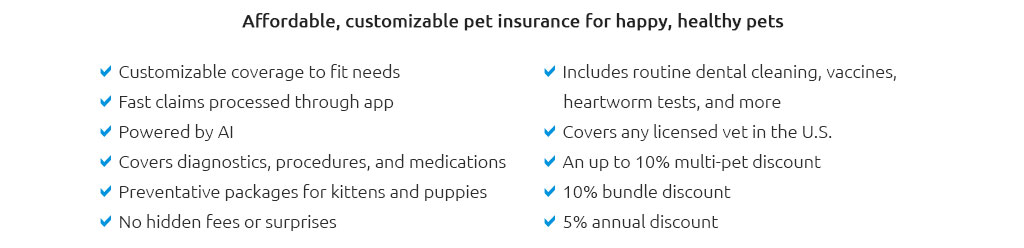

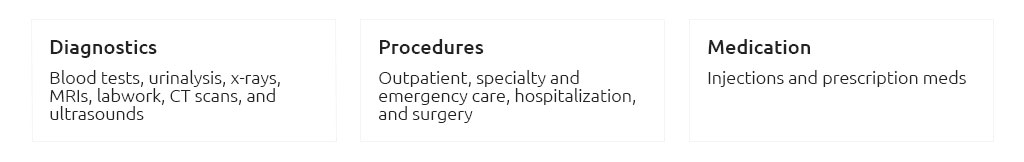

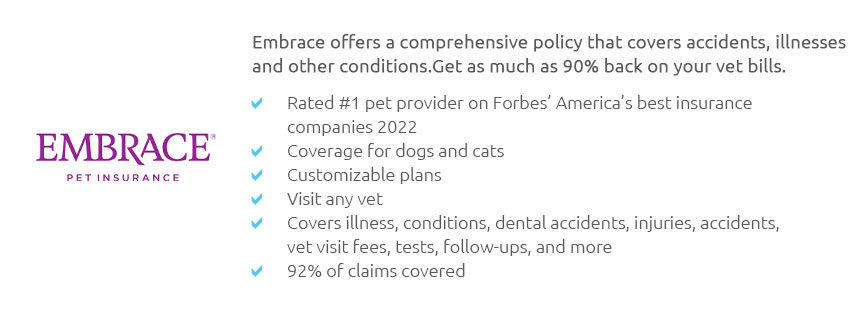

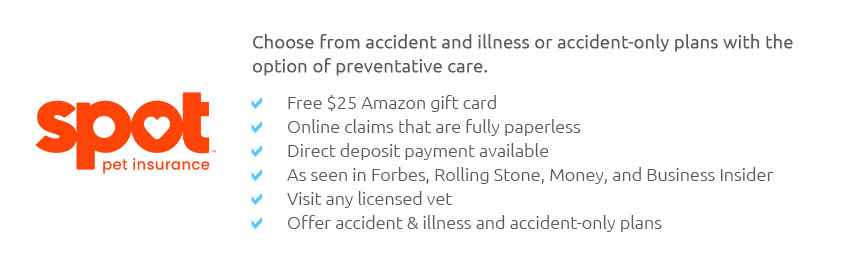

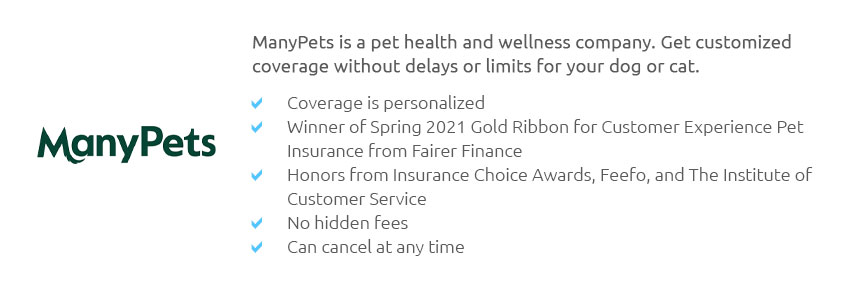

Comparing Pet Insurance Plans: Finding the Right Fit for Your Furry FriendWhen it comes to safeguarding the health and happiness of your beloved pet, navigating the world of pet insurance can feel overwhelming. With a myriad of options available, each offering a unique set of benefits and limitations, making an informed decision is crucial. In this comprehensive guide, we'll explore the nuances of comparing pet insurance plans, helping you find a policy that best suits your needs and those of your furry companion. Pet insurance is, at its core, a safety net that provides financial assistance for veterinary expenses. However, not all policies are created equal, and the key to selecting the right one lies in understanding the fine print and considering your pet's specific needs.

When comparing pet insurance plans, it's important to tailor your choice to your pet's individual needs and your financial situation. If your pet is prone to certain health issues due to its breed, prioritizing a comprehensive accident and illness plan might be wise. Alternatively, if you're primarily concerned with unexpected accidents, a more affordable accident-only plan could suffice. In conclusion, while navigating the pet insurance landscape may initially seem daunting, taking the time to compare plans based on coverage, cost, and customer satisfaction will ultimately pay off. By choosing a plan that aligns with your pet's health requirements and your budgetary constraints, you can ensure peace of mind and focus on creating cherished memories with your four-legged friend. https://www.pawlicy.com/blog/pet-insurance-comparison/

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up ... https://www.youtube.com/watch?v=yHPgoPtNg7g

Struggling to understand pet insurance and which one to choose? I've got you covered! Need help with a pet?

|